How Does Hurricane Insurance Coverage Differ From Standard Homeowners' Insurance Policies?

When the unexpected happens, we help individuals and businesses collect the money they deserve for their insurance claims.

Melamed Blogs

December 14, 2025

How Does Hurricane Insurance Coverage Differ From Standard Homeowners' Insurance Policies?

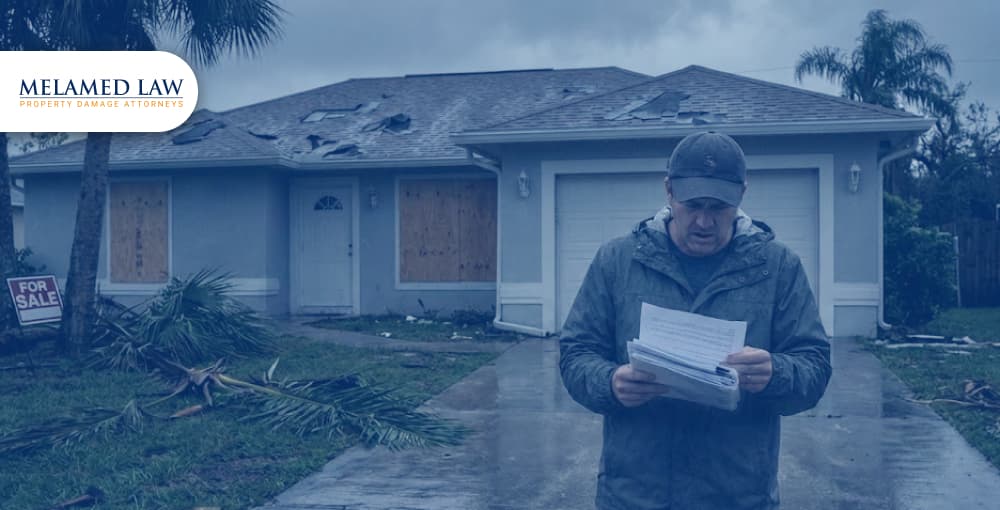

The reality of insurance coverage in Florida is far more harsh. There is a massive difference between a standard homeowners insurance policy and the coverage that activates during a hurricane. That difference often leaves families with ruined homes and empty bank accounts. The insurance companies know this. They count on your confusion. They write policies that are intentionally difficult to understand so they can protect their profits instead of your property.

Every day at Melamed Law PLLC, we witness the consequences of this deception. We witnessed decent people who believed they were covered being turned down. Families that failed to read the fine print end up in financial ruin. Our goal is to alter that story. We defend policyholders who are being exploited by large insurance companies.

1) The Myth of Standard Protection

Florida law allows insurance companies to change the rules entirely during a hurricane. The triggers change. The costs change. The coverage itself changes. NOAA clarifies that hurricane deductibles and triggers activate when the National Hurricane Center issues a watch or warning.

The insurance adjuster is no longer trying to assist you. They are searching for weaknesses. They are searching for exclusions. They are searching for any excuse to claim that your regular policy does not cover the damage to your house.

This is a business strategy. Insurance carriers are for-profit entities. They make money by collecting premiums and lose money by paying claims. Their goal is to pay you as little as possible. When a hurricane causes billions of dollars in damage across the state, the insurers go into defensive mode. They deploy armies of adjusters and lawyers to limit their liability.

You cannot fight that army alone. You need a legal team that understands their tactics. Melamed Law PLLC does not get intimidated by big insurance carriers. We know their playbook better than they do. We know that the "standard" protection you think you have is often an illusion. We are the ones who force them to honor their promises.

2) The Deductible Trap

The most immediate financial shock for homeowners is the hurricane deductible. This is the primary tool insurers use to shift the cost of the storm onto your shoulders.

Under a standard policy claim, you might pay a flat fee of five hundred or one thousand dollars. That is manageable for most families. It is a minor inconvenience in the face of a disaster.

Hurricane claims function differently.

When the National Weather Service issues a watch or warning, the standard deductible vanishes. It is replaced by a hurricane deductible. This is not a flat fee. It is a percentage of the insured value of your home. This percentage is typically set at two percent, five percent, or even ten percent. Florida’s Office of Insurance Regulation confirms these percentage-based hurricane deductibles.

Consider a home insured for five hundred thousand dollars. A two percent deductible means you are responsible for the first ten thousand dollars of damage. A five percent deductible means you must pay twenty-five thousand dollars before the insurance company contributes a single penny.

This is where the insurance company wins. Many storms cause moderate damage. You might lose some shingles and have a few broken windows and suffer some water intrusion. The total repair cost might be fifteen thousand dollars. If you have a five percent deductible on a five hundred thousand dollar home, your deductible is twenty-five thousand dollars. The damage is less than the deductible. The insurance company pays nothing, and you pay for everything.

3) The Battle of Wind Versus Water

The hurricane deductible is just the first hurdle. The second and more dangerous trap is the distinction between wind damage and water damage.

Standard homeowners policies cover wind. They cover damage caused by rain entering through an opening the wind created. If the wind rips your roof off and rain pours into your living room, that is a covered loss.

Standard homeowners policies almost never cover flood damage.

This seems like a simple distinction on paper. In the chaos of a hurricane, it is anything but simple. Hurricanes bring both wind and water. A storm surge rises from the ocean. Rain falls from the sky. Windows break and roofs fail. When the storm passes, the home is left wet and damaged.

The insurance company plays its favorite game at this point. When they see a completely destroyed house, they will just say "flood." They will assert that the water rose from the ground, which is not covered by your policy. The evidence that the home was first exposed to the elements by wind will be disregarded. The fact that the rain was driven horizontally through the stucco cracks by the wind will go unnoticed by them.

They do this because denying a claim based on the flood exclusion saves them millions of dollars. They put the burden of proof on you. They expect you to prove exactly how the water entered your home. They expect you to separate the wind damage from the flood damage while you are trying to salvage your personal belongings.

It is an unfair fight. They have engineers and experts on their payroll who are trained to write reports that favor the insurance company. They will produce a slick document stating that the damage was caused by rising water. If you do not have an advocate, you will likely accept their denial and give up.

4) The Tactics of Delay and Denial

The differences between standard and hurricane insurance create opportunities for bad behavior. Insurance companies know that you are vulnerable after a storm. You are likely without power. You might be displaced from your home. You are stressed and tired and desperate for a resolution.

They use this leverage against you.

You might experience long delays in communication. You call your adjuster and get voicemail. You send emails and get no response. They might ask for the same documents over and over again. They might send you a "reservation of rights" letter, which sounds ominous and confusing. These are delay tactics. They want you to get frustrated. They want you to settle for a lowball offer just to make the process end.

Another common tactic is the "wear and tear" excuse. The adjuster will look at your roof and say the damage is not from the hurricane but from the age of the roof. They will claim the shingles were already loose or the tiles were already cracked. They try to frame a sudden catastrophic event as a maintenance issue. This allows them to deny coverage under both standard and hurricane provisions.

These tactics are not just annoying. They can be illegal. Florida has laws regarding bad faith insurance practices. Insurers have a duty to investigate claims promptly and fairly. When they fail to do so, they are breaking the law.

Identifying bad faith requires a trained eye. It requires a legal professional who knows the statutes and the case law. It requires someone who can look at a claim file and spot the pattern of neglect and deception. Melamed Law PLLC specializes in holding these companies accountable. We expose their delay tactics. We challenge their unfair denials. We demand the respect and the compensation you deserve.

5) Why You Need Melamed Law PLLC

The insurance policy you hold is a contract. It is a dense legal document filled with exclusions and conditions and endorsements. The insurance company wrote that contract. They wrote it to favor themselves. When you try to interpret that contract on your own, you are playing a game where the other side made the rules and hired the referees.

You need a team that levels the playing field.

Melamed Law PLLC provides aggressive representation for Florida homeowners. We are a dedicated practice that provides personal attention to every client. We understand that your home is your most valuable asset. We understand that a denied claim feels like a betrayal.

Our approach is thorough. We do not just read your policy. We dissect it. We look for every possible avenue of coverage. We analyze the adjuster's report to find errors and inconsistencies. We handle all communication with the insurance company so you do not have to deal with their harassment.

We are also prepared to litigate. Many law firms want to settle quickly and move on. We are different. If the insurance company refuses to make a fair offer, we are ready to take them to court. We build every case as if it is going to trial. This aggressive stance often forces the insurance company to come to the table with a serious offer because they know we will not back down.

6) The Cost of Inaction

Time is your enemy in a hurricane claim. Florida has strict statutes of limitations for filing claims. The Florida Division of Consumer Services explains these deadlines, showing how quickly homeowners must file hurricane claims and what steps insurance companies are legally required to follow to respond fairly.

Do not let them dictate the timeline. Do not let them control the narrative.

When you hire Melamed Law PLLC, you send a clear message to the insurer. You are telling them that you will not be bullied. You are telling them that you know your rights. You are telling them that you have a professional advocate who will fight for every dollar you are owed.

Let us review your case. Let us look at the facts. Let us determine if the insurance company is acting in good faith.

Contact us today. Let us take the fight to them. Your home is worth fighting for, and we are the firm that will fight for you.

Disclaimer: The information contained within the post published by Melamed Law PLLC is provided for educational and informational purposes only. This content is not intended to be a substitute for professional legal advice. It is not designed to establish a lawyer-client relationship.

Recent Cases